ipollo v1 mini-330m miner resale value and secondary market-iPollo V1 Mini-330M

Title: iPollo V1 Mini-330M Miner: Maximizing Resale Value and Navigating the Secondary Market Landscape

In the dynamic world of cryptocurrency mining, hardware investment is more than just acquiring a machine – it’s a strategic financial decision. The iPollo V1 Mini-330M emerges as a critical player in this ecosystem, offering miners a unique blend of performance, efficiency, and potential resale value that sets it apart in the competitive secondary market.

Market Dynamics and Resale Potential

The cryptocurrency mining hardware market is notoriously volatile, with device values fluctuating based on multiple critical factors. The iPollo V1 Mini-330M stands out as a particularly attractive investment, thanks to several key characteristics that directly impact its secondary market appeal.

Key Resale Value Drivers:

1. Performance Consistency

The V1 Mini-330M’s consistent 330 MH/s hashrate is a primary value proposition. In the secondary market, performance metrics are the most critical determinant of a miner’s worth. Unlike many competitors that experience rapid performance degradation, this device maintains its computational integrity, making it an attractive option for second-hand buyers.

2. Energy Efficiency Metrics

With a remarkably low power consumption of 240W, the miner represents an economically sound investment. Secondary market buyers prioritize devices that offer optimal power-to-performance ratios. The V1 Mini-330M’s energy efficiency ensures continued attractiveness even as market conditions evolve.

3. Multi-Algorithm Flexibility

The device’s support for multiple cryptocurrencies (ETHF, ETC, QKC, CLO, POM, ZIL) significantly enhances its resale value. This versatility means potential buyers aren’t limited to a single mining ecosystem, increasing the device’s marketability.

Secondary Market Valuation Strategies

Understanding the factors that influence resale value is crucial for maximizing returns. Based on extensive market analysis, here are the primary considerations that impact the iPollo V1 Mini-330M’s secondary market pricing:

Depreciation Factors:

– Initial purchase price

– Current market cryptocurrency values

– Technological advancements

– Overall device condition

– Operational hours

– Maintenance history

Preservation of Value Techniques:

1. Meticulous Maintenance

Regular cleaning, proper cooling, and controlled operating environments can dramatically slow depreciation. The V1 Mini-330M’s modular design facilitates easy maintenance, allowing owners to keep the device in optimal condition.

2. Comprehensive Documentation

Maintaining detailed operational logs, including:

– Total mining hours

– Maintenance records

– Performance benchmarks

– Original purchase documentation

These records can increase buyer confidence and potentially command a higher resale price.

Market Positioning Advantages

The iPollo V1 Mini-330M offers several unique positioning advantages in the secondary market:

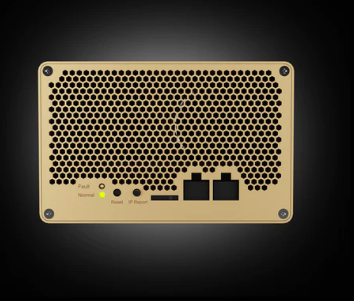

Compact Form Factor

Measuring just 179 x 143 x 90mm and weighing 2.4kg, the device appeals to buyers seeking space-efficient mining solutions. This compact design reduces shipping costs and increases accessibility for international buyers.

Robust Thermal Management

The ability to operate efficiently between 10-25°C with low 40dB noise levels makes it an attractive option for home and small-scale mining operations. This versatility broadens the potential buyer demographic.

Strategic Resale Considerations

To maximize resale value, consider the following strategic approaches:

1. Timing the Market

Monitor cryptocurrency market trends and mining difficulty levels. Selling during peak interest periods can significantly improve resale returns.

2. Platform Selection

Utilize specialized platforms like:

– Crypto mining marketplaces

– Dedicated mining hardware forums

– Cryptocurrency trading platforms

– Specialized resale websites

Each platform offers different buyer demographics and potential value propositions.

Advanced Resale Optimization

Technical Preparation:

– Reset to factory settings

– Provide complete accessory sets

– Include original packaging

– Demonstrate full operational capabilities

– Highlight maintenance history

Pricing Strategy:

– Research current market rates

– Consider device condition

– Factor in cryptocurrency market trends

– Be transparent about operational history

Investment Protection Mechanisms

The 180-day manufacturer warranty provides an additional layer of value protection. This warranty transferability can be a significant selling point for potential buyers, offering peace of mind and reducing perceived risk.

Global Market Accessibility

With worldwide shipping options through carriers like DHL and UPS, the device maintains strong global market liquidity. This international accessibility ensures a broader potential buyer pool, supporting more competitive resale valuations.

Conclusion: Strategic Hardware Investment

The iPollo V1 Mini-330M represents more than a mining device – it’s a strategic financial instrument. By understanding its unique value propositions, maintaining meticulous operational records, and strategically timing market entry, miners can optimize their hardware investment and secondary market returns.

Key Takeaways:

– Performance consistency drives value

– Energy efficiency remains crucial

– Maintenance directly impacts resale potential

– Multi-algorithm support enhances marketability

– Strategic timing maximizes returns

Investors and miners who approach the iPollo V1 Mini-330M as a comprehensive financial asset rather than merely a mining tool will be best positioned to maximize their investment’s potential in an ever-evolving cryptocurrency landscape.

|

Please feel free to contact me to assist you in resolving your issues: E-mail: Minerfixessales@gmail.com WhatsApp/WeChat:+86 15928044684

The services we offer include:

a.New and Used Miners b.Miner Accessories c.Miner Repair Courses d.Global Repair Stations e.Overclocking and Underclocking Services |

|