How to evaluate the ROI of Lucky Miner LV06 for cryptocurrency mining?

How to Evaluate the ROI of Lucky Miner LV06 for Cryptocurrency Mining?

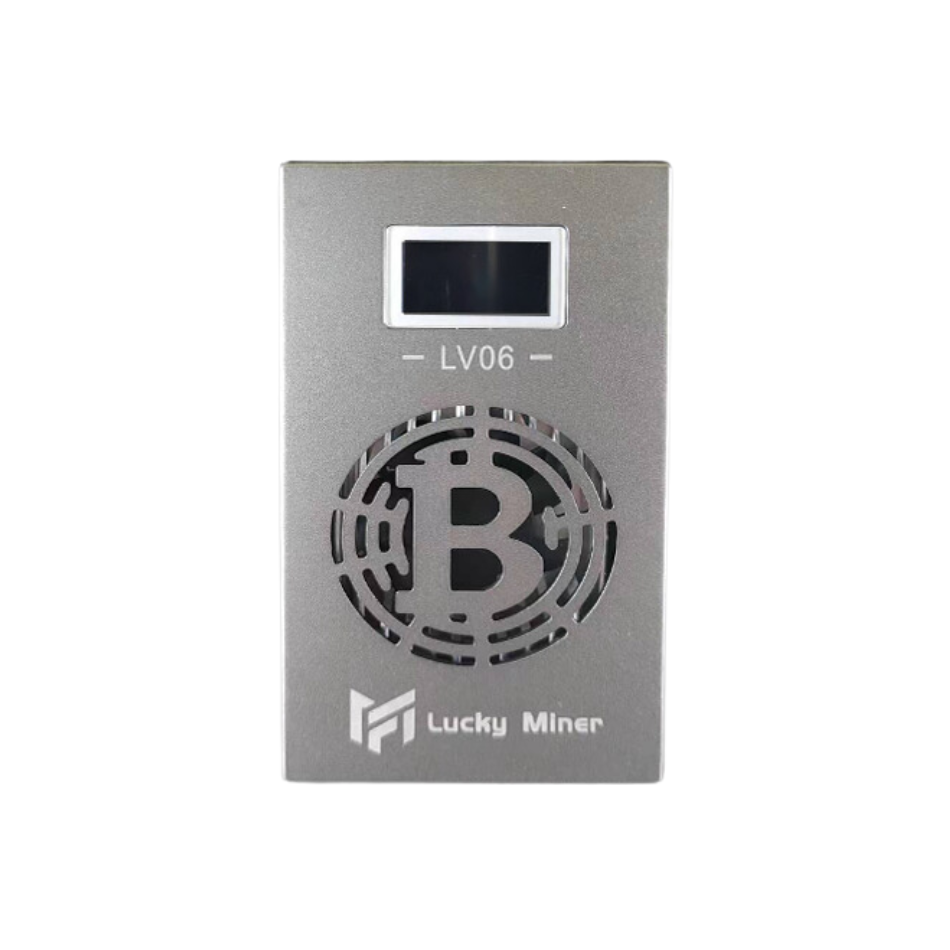

Cryptocurrency mining has evolved significantly over the years, with advancements in technology making it more accessible and efficient. One such innovation is the Lucky Miner LV06, a portable ASIC mining device that combines professional-grade performance with user-friendly features. For mining operators and cryptocurrency enthusiasts, evaluating the return on investment (ROI) of mining hardware is crucial to ensure profitability. In this article, we’ll explore how to assess the ROI of the Lucky Miner LV06, taking into account its technical specifications, operational advantages, and real-world applications.

Product Introduction: The Lucky Miner LV06

The Lucky Miner LV06 is a compact yet powerful ASIC miner designed for SHA-256 algorithm cryptocurrencies like Bitcoin (BTC), Bitcoin Cash (BCH), and Bitcoin SV (BSV). It stands out in the crowded mining hardware market due to its unique combination of portability, efficiency, and versatility. Here’s a quick overview of its key features:

- Hash Rate: 500 GH/s (±10%)

- Power Consumption: 13 watts (±5%)

- Noise Level: Below 35dB

- Dimensions: 130x66x40mm

- Weight: 208g

- Connectivity: Integrated WiFi, universal power input (5V, ≥4A)

- Supported Cryptocurrencies: 42 SHA-256 coins

- Mining Protocols: SOLO, PPLNS, PPS, PROP

With its advanced 5nm ASIC chip, the LV06 delivers professional-grade performance while maintaining exceptional energy efficiency. Its compact design and near-silent operation make it suitable for home offices, apartments, and other noise-sensitive environments.

Why ROI Matters in Cryptocurrency Mining

Before diving into the specifics of the LV06, it’s essential to understand why ROI is a critical metric for mining operators. ROI measures the profitability of an investment by comparing the gains to the initial cost. In mining, this includes factors like:

- Hardware Cost: The upfront price of the mining device.

- Operational Costs: Electricity consumption, cooling, and maintenance.

- Mining Rewards: The value of cryptocurrencies mined over time.

- Market Conditions: Cryptocurrency prices, network difficulty, and mining pool fees.

By evaluating these factors, miners can determine whether the LV06 is a worthwhile investment for their specific needs.

Key Factors to Evaluate the ROI of Lucky Miner LV06

1. Hash Rate and Mining Efficiency

The LV06’s hash rate of 500 GH/s places it in the mid-to-high range of portable ASIC miners. While it may not compete with industrial-grade rigs, its efficiency makes it ideal for small-scale operations. The 5nm ASIC chip ensures optimal performance while minimizing power consumption, which directly impacts operational costs.

Practical Insight: For miners targeting SHA-256 cryptocurrencies, the LV06’s hash rate provides a solid foundation for consistent rewards. Its efficiency also means lower electricity bills, which is particularly beneficial in regions with high energy costs.

2. Power Consumption and Energy Efficiency

One of the standout features of the LV06 is its power consumption of just 13 watts. This is significantly lower than many competing devices, making it one of the most energy-efficient miners in its class. Lower power consumption translates to reduced operational expenses, which is a major factor in ROI calculations.

Practical Insight: To put this into perspective, running the LV06 24/7 for a month would consume approximately 9.36 kWh of electricity. At an average electricity rate of $0.12 per kWh, this amounts to just $1.12 per month in energy costs. This low overhead makes the LV06 an attractive option for miners looking to maximize profitability.

3. Portability and Flexibility

The LV06’s compact design and lightweight build (208g) make it highly portable, allowing miners to deploy it in various settings. Its universal power input (100-240V) and integrated WiFi connectivity further enhance its flexibility, enabling seamless integration into existing setups.

Practical Insight: For miners who frequently relocate or operate in multiple locations, the LV06’s portability ensures uninterrupted mining operations. This adaptability can lead to increased mining opportunities and higher overall returns.

4. Noise Levels and Environmental Suitability

Operating at less than 35dB, the LV06 is one of the quietest miners available. This makes it suitable for home offices, apartments, and other noise-sensitive environments where traditional mining rigs would be impractical.

Practical Insight: The ability to mine in residential settings without disturbing others is a significant advantage. It eliminates the need for dedicated mining facilities, reducing additional costs associated with space rental and cooling systems.

5. Supported Cryptocurrencies and Mining Protocols

The LV06 supports 42 SHA-256 cryptocurrencies, including Bitcoin, Bitcoin Cash, and Bitcoin SV. It also offers flexibility in mining protocols, supporting SOLO, PPLNS, PPS, and PROP modes. This versatility allows miners to adapt to changing market conditions and optimize their strategies.

Practical Insight: By diversifying mining efforts across multiple cryptocurrencies, miners can mitigate risks associated with price volatility. Additionally, the ability to switch between mining protocols enables miners to maximize rewards based on pool performance and payout structures.

6. Initial Investment and Payback Period

The upfront cost of the LV06 is a critical factor in ROI calculations. While prices may vary depending on the retailer, the LV06 is generally positioned as an affordable entry point for both beginners and experienced miners. Its low operational costs and efficient performance contribute to a shorter payback period.

Practical Insight: Assuming a purchase price of $500 and monthly electricity costs of $1.12, the LV06’s payback period will depend on mining rewards. For example, if the device generates $50 worth of cryptocurrency per month, the payback period would be approximately 10 months. This is a competitive timeframe compared to many other mining devices.

Real-World Applications and ROI Scenarios

To illustrate the practical value of the LV06, let’s consider two hypothetical scenarios:

Scenario 1: Home Miner in a High-Electricity-Cost Region

- Electricity Rate: $0.20 per kWh

- Monthly Electricity Cost: $1.87

- Monthly Mining Revenue: $50

- Payback Period: ~10 months

In this scenario, the LV06’s low power consumption helps offset high electricity costs, ensuring a reasonable payback period.

Scenario 2: Mobile Miner in a Low-Electricity-Cost Region

- Electricity Rate: $0.08 per kWh

- Monthly Electricity Cost: $0.75

- Monthly Mining Revenue: $50

- Payback Period: ~10 months

Here, the LV06’s portability and efficiency allow the miner to capitalize on low electricity rates, further enhancing profitability.

Conclusion: Is the Lucky Miner LV06 Worth It?

The Lucky Miner LV06 is a compelling option for cryptocurrency miners seeking a balance between performance, efficiency, and affordability. Its advanced 5nm ASIC chip, low power consumption, and versatile mining capabilities make it a strong contender in the portable mining market. When evaluating its ROI, factors like hash rate, energy efficiency, and initial investment play a crucial role in determining profitability.

For small-scale miners and those operating in noise-sensitive environments, the LV06 offers a practical and cost-effective solution. Its short payback period and low operational costs make it an attractive choice for both beginners and experienced miners looking to diversify their operations.

Ultimately, the ROI of the LV06 will depend on individual circumstances, including electricity costs, cryptocurrency prices, and mining strategies. However, its combination of technical excellence and user-friendly design positions it as a valuable tool in the ever-evolving world of cryptocurrency mining.